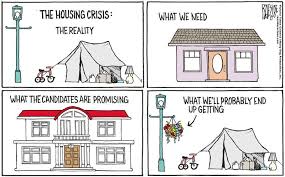

Housing crisis.. Made in Canada

It’s really not that complicated. If you really want to resolve the housing crisis you just need to do these FIVE things

- 1. Bring back 35 year amortization periods and increase qualifying home prices to $1,250,000 or higher.

- 2.Remove rent control rules.

- 3.Halt new immigration until we can build up enough support services to handle what we have already. *(exception below)

- 4.Cut back on the municipal, provincial gov’t Red Tape to build any type of residential housing and that includes purpose built rental apartment buildings.

- 5.Create a hiring program to entice and incentivize people to get into skilled trades …and bring over people from outside Canada if you have to (this would be my exception to point 2 above)

- Do this and you’ll soon have more housing units available than you could even dream of. It could be done in 3 to 5 years. It’s just not that complicated.