It’s Financial Literacy Month

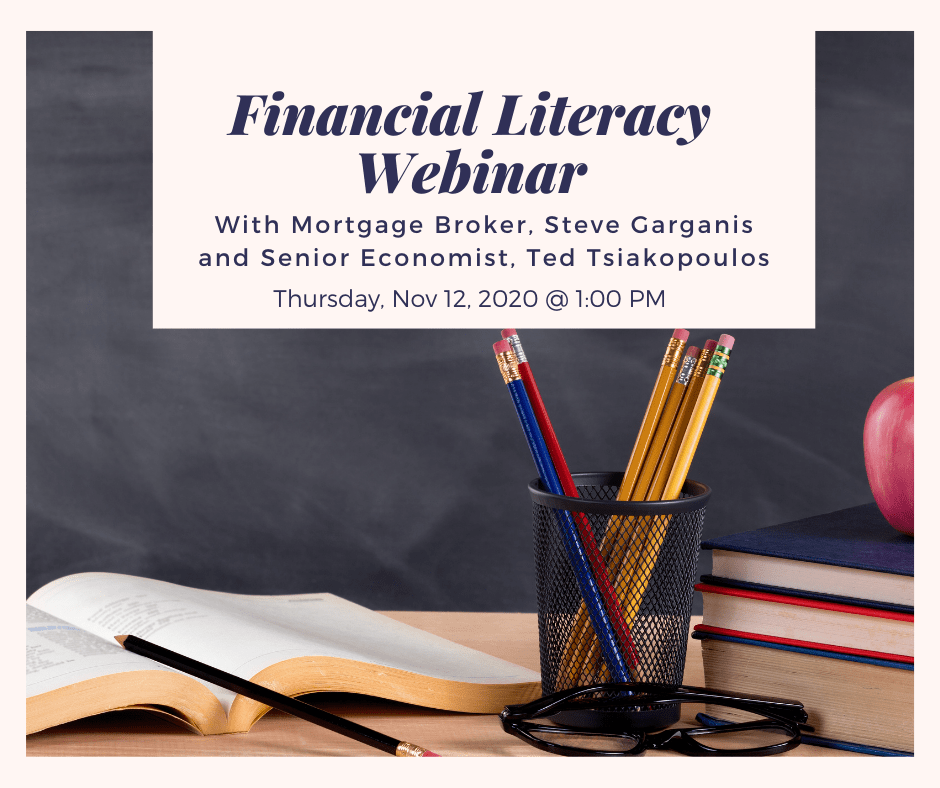

We’re celebrating Financial Literacy Month!

Join Senior Economist, Ted Tsiakopoulos and Mortgage Broker, Steve Garganis Thursday, Nov 12, 2020, at 1:00 PM Eastern Time for a chat about budgets, savings, debt, and more.

N

Register Now: https://buff.ly/3lhmUl3

Hot Topics:

- Interest Rates, Savings, Debt and Budgeting trends

- Good debt vs bad debt: How debt affects the economy, housing prices and financial stability

- Bankruptcy vs Consumer Proposal.

- Bank of Canada interest rate policy now till 2023 – Risks??

- Why the second line of defence (macroprudential policies) is necessary despite the recent rise in savings

- Where does the problem lie? Disaggregating debt to asset ratio by age and income

- Trends in financial literacy

- Disruptions coming post-COVID & importance of financial literacy & skills