Choose short term money for long term gains.

Only recently has 5 year fixed rate become a product worth considering when it comes to paying the least amount of interest on your mortgage. Studies prove that short term mortgage funds are the cheapest way to finance a house.. this includes Variable rate mortgages.

Only recently has 5 year fixed rate become a product worth considering when it comes to paying the least amount of interest on your mortgage. Studies prove that short term mortgage funds are the cheapest way to finance a house.. this includes Variable rate mortgages.

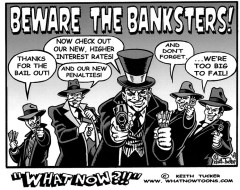

Historically, Variable rate and short term fixed rates have had lower rates than long term rates. And yet, the BIG SIX BANKS, the Federal govt, and several popular finance experts have preached 5 yr fixed. ‘You must take 5 year fixed so you know what your rate is.’ That’s a load of nonsense. It’s true, that over the past 2 years, 5 yr fixed did make more sense given that the spread between Variable and Fixed was less than my target of 1.00%. (I like to see a 1.00% spread between Variable and 5 yr fixed before recommending Variable). Continue reading “Choose short term money for long term gains.”