More disclosure.. but still no standardization of Mortgage Penalties.

Last week, we heard some potentially good news for Canadian consumers. Federal Finance Minister, Joe Oliver, announced Banks would have to provide consumers more disclosure on certain products, including collateral mortgages. We welcome more disclosure.

Last week, we heard some potentially good news for Canadian consumers. Federal Finance Minister, Joe Oliver, announced Banks would have to provide consumers more disclosure on certain products, including collateral mortgages. We welcome more disclosure.

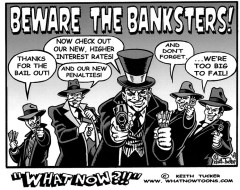

However, before we get too excited and give the Federal govt too much credit, let’s wait to see if this latest promise really happens. If you are wondering why I’m so skeptical, it’s with good reason. The Federal govt has not honored their commitments before. And I’m talking about the promise made to Canadians to charge a fair prepayment penalty… Remember that one? Continue reading “More disclosure.. but still no standardization of Mortgage Penalties.”